(HedgeCo.Net) A major structural transition in the hedge-fund ecosystem is the growing prominence of separately managed accounts (SMAs) and evolving fee dynamics. Research and industry commentary show that SMAs are increasingly favoured by investors seeking transparency, customization and control. Dechert+1

What Are SMAs?

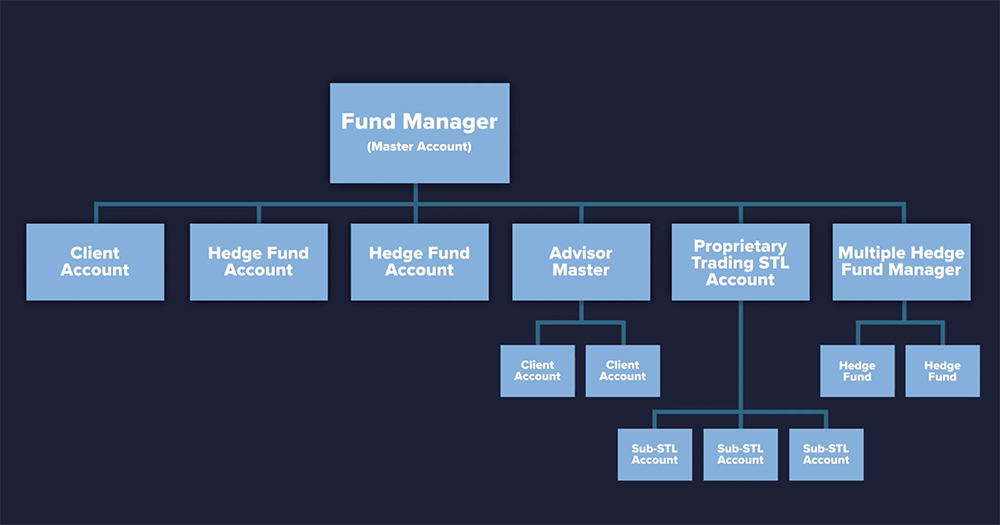

SMAs are investment accounts where the investor holds their own account rather than participating in a pooled fund. In the hedge context, they allow investors to:

- Monitor holdings and exposures directly

- Negotiate fee and liquidity terms

- Customize constraints (ESG, tax, risk limits)

This trend reflects investor demand for more tailored access rather than generic pooled structures.

Fee/Structure Developments

Another related shift: allocator pressure on fee models. From a recent “Four allocator demands” piece:

- New relationships are more important than ever.

- We may have passed “peak fee compression” but the pressure remains.

- Operational alpha (i.e., manager’s operational infrastructure, platform, risk management) is now critical.

- Scaling remains a structural challenge for many managers. hedgeweek.com

Implications

- Managers must adapt: Offering vintage access (SMAs), co-investment rights, customized terms and transparent operational practises will matter.

- Cost structure matters: Fee models are evolving—investors pushing for lower management fees, hurdle rates, performance-fee alignment and more favourable liquidity.

- Differentiation through operations: As investment strategies mature, operational excellence (risk, infrastructure, service) becomes a differentiator.

Key takeaway

The hedge-fund industry is not only about returns any more — how you structure access and align with investors counts just as much. Customization (via SMAs) and fee/operational discipline are becoming front-of-mind. For managers and allocators alike, staying ahead of this trend matters.