(HedgeCo.Net) This year, strategy dynamics in the hedge-fund world show multi-strategy funds gaining ground — both in performance and investor interest. According to Business Insider, hedge funds are on pace for their best year since the pandemic era, and multi-strategy firms are outperforming. Business Insider+1

Performance Trends

- Multi-strategy hedge funds delivered average returns of ~19.3% in 2025 so far, per Citco data. Business Insider

- Each major hedge-fund strategy posted positive returns in the year to date, and ~80 % of funds were in gain mode.

- New launches are accelerating. According to a report, new hedge-fund launches surged in Q2 and beyond, especially in equity-hedge and macro strategies. The Full FX

Why These Strategies Are Rising

- Market volatility and dispersion (between sectors, regions) offers opportunity for multi-strategy firms that can pivot across asset classes.

- Macro dislocation: central-bank divergence, inflation, geopolitical shocks are increasing the opportunity set for global macro, event-driven, relative value and other specialist hedge-fund strategies.

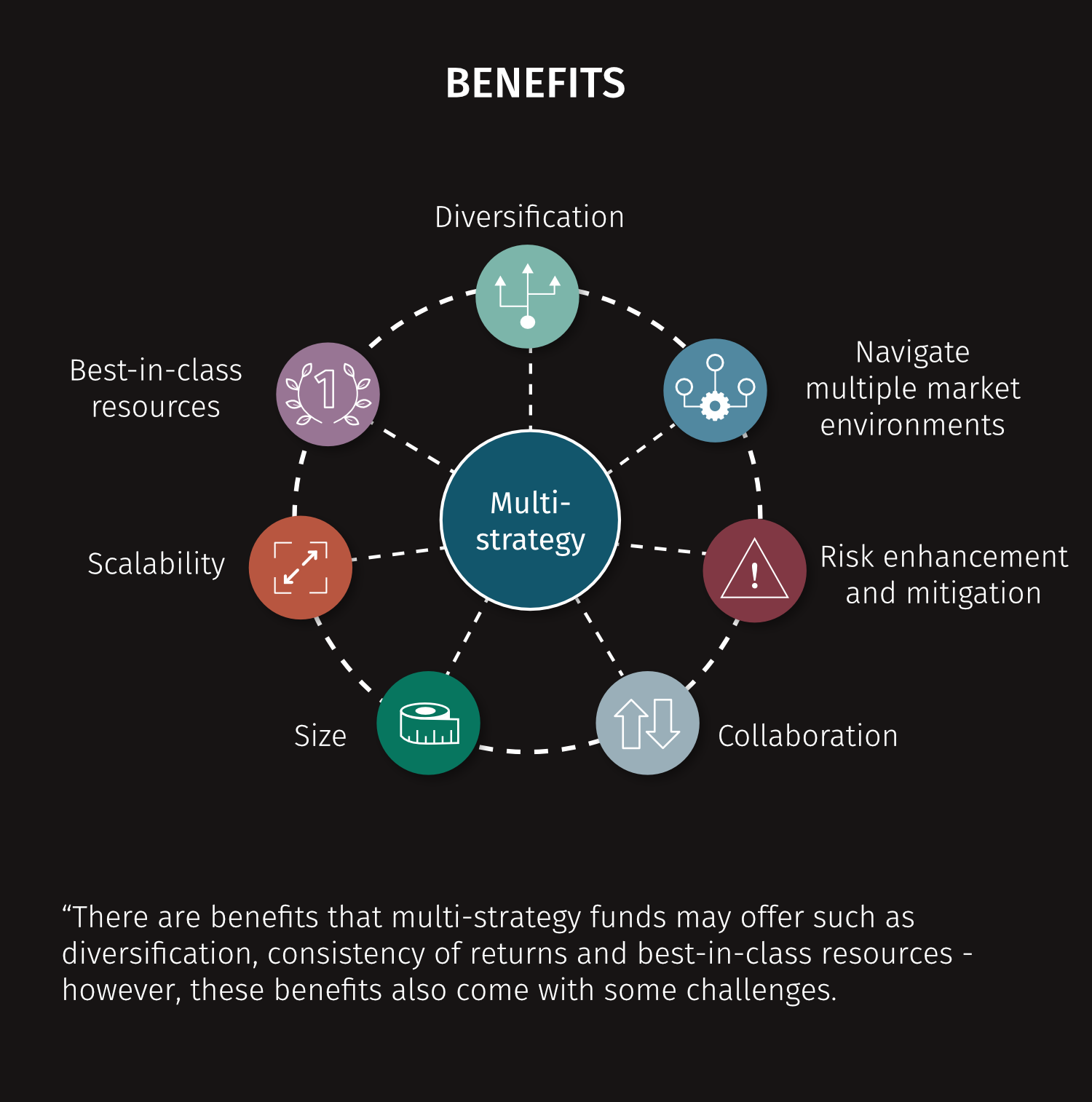

- Capital flows favouring diversifiers: investors are allocating to managers that span several strategies (multi-strategy) rather than single-theme funds, in part to access “one-stop” alternative solutions.

Implications

- Larger platforms benefit: Multi-strategy firms often have scale, diversified teams and internal platforms, making them attractive to institutional allocators.

- Launch environment favourable: New managers still have runway, but the bar is higher: performance, operational infrastructure and strategy clarity matter.

- Strategy crowding risk: As more capital flows into these “winning” strategies, alpha dilution and capacity constraints may creep in.

Key takeaway

Multi-strategy hedge funds are in ascendancy in 2025—both in terms of performance and investor interest. For allocators seeking diversified exposure and for managers aiming to attract capital, structuring around multi-strategy capabilities may be an increasingly effective model.