(HedgeCo.Net) In a bold strategic pivot that signals a broader industry shift, billionaire Steve Cohen’s Point72 Asset Management, managing $41.5 billion in assets, is preparing to launch into the private credit space. This move, reported by Bloomberg, places Point72 alongside other hedge fund giants like Millennium Management and Jain Global in targeting longer-term, illiquid investments traditionally dominated by private equity behemoths such as Blackstone and Ares Management.

The expansion comes amid a booming private credit market, where hedge funds are leveraging their expertise in risk pricing and talent pools to compete for deals. Private credit has exploded in popularity as banks retreat from certain lending due to regulatory pressures, creating opportunities for alternative lenders to fill the void with direct loans to companies.

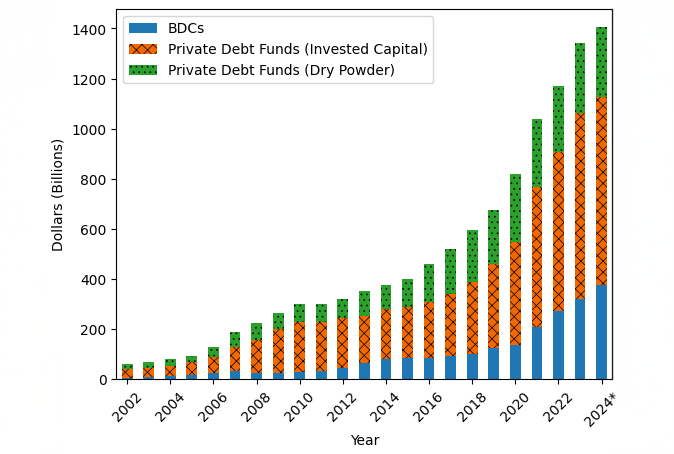

Inside Steve Cohen and Point72’s Network of Hedge-Fund Founders …Cohen, the former SAC Capital chief who rebuilt his empire as a family office before converting Point72 into a hedge fund open to outside investors, has been pitching this new private credit strategy to potential limited partners in recent weeks. Sources indicate that Point72 aims to capitalize on its agile decision-making and performance-driven culture to offer competitive terms in a market projected to exceed $2 trillion in assets by 2030.

This isn’t an isolated move. The hedge fund industry is increasingly blurring lines with private markets. Firms like Brevan,</b> Howard have made significant allocations to healthcare-focused private equity-like funds, while multi-strategy platforms see private credit as a way to lock in capital for longer periods and generate stable, fee-rich returns. The appeal is clear: private credit offers yields often 5-10% above public high-yield bonds, with lower volatility in many cases.

Industry experts note that hedge funds bring unique advantages to private credit. Their quantitative teams and global macro insights allow for sophisticated covenant structuring and risk assessment, potentially giving them an edge over traditional private debt managers. However, challenges remain, including the need for patient capital and the illiquidity premium that investors demand.

Point72’s entry could accelerate consolidation in private credit, where the top 10 managers already control a significant portion of the market. For Cohen, whose net worth exceeds $20 billion, this represents a maturation of Point72 from a pure long/short equity shop to a diversified alternative asset manager.

The implications for investors are profound. As hedge funds enter private credit, limited partners may gain access to hybrid vehicles combining liquid hedge strategies with illiquid private lending, potentially smoothing returns in volatile equity markets.

As of late 2025, the private credit sector has seen record fundraising, with dry powder (uncommitted capital) hitting all-time highs. Point72’s push, combined with similar efforts from peers, could intensify competition for deals, compressing spreads but also driving innovation in areas like distressed debt and specialty finance.

This trend underscores a larger evolution in alternatives: hedge funds, once defined by short-term trading, are increasingly becoming all-weather asset managers. For Cohen and Point72, private credit isn’t just diversification—it’s the next frontier in alpha generation.