(HedgeCo.Net) The U.S. regulator has signaled a shift in approach. The SEC has announced “Project Crypto”, an initiative aimed at modernising securities rules and enabling financial markets to move more on-chain. PYMNTS.com

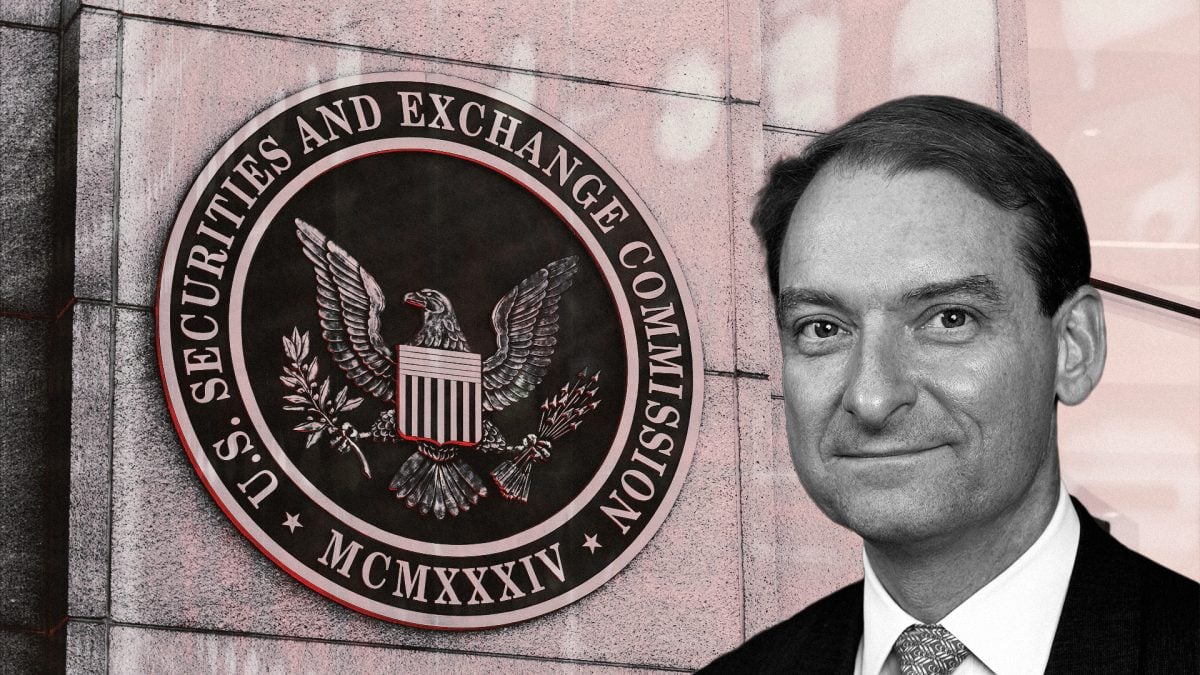

Background: In a speech at the America First Policy Institute, the SEC’s leadership framed the effort as part of Paul S. Atkins’ vision to reposition the U.S. as the “crypto capital of the world”. PYMNTS.com

Why it matters: By modernising rules to allow tokens and digital assets to more seamlessly integrate with regulated markets (e.g., exchanges, clearing), the U.S. may open new pathways for institutional capital, tokenised securities, and bridging between TradFi and crypto.

What to watch:

- How fast regulatory rule-making moves and whether safe-harbor regimes or token exchange frameworks emerge.

- Reactions from token issuers: will they pursue SEC compliance or look to other jurisdictions?

- Market impact: clearer regulatory paths may reduce risk premiums, but also raise entry costs or compliance burdens.