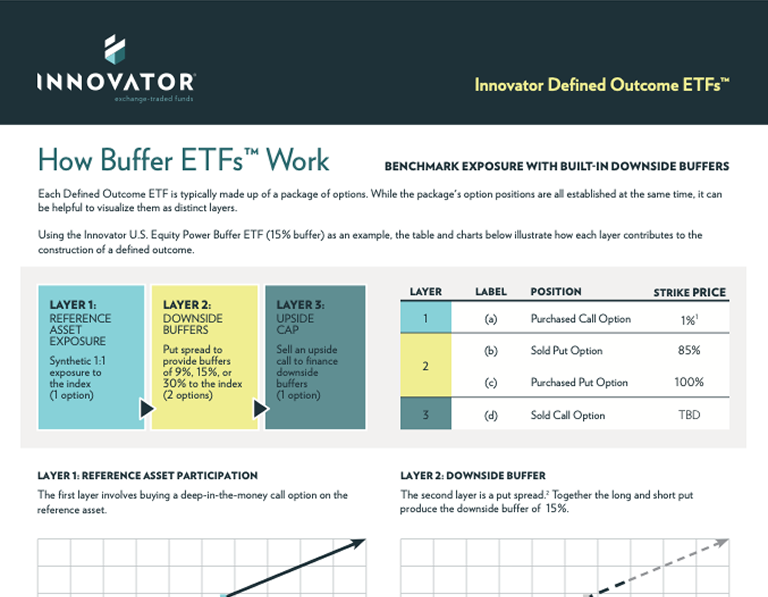

(HedgeCo.Net) Among 2025’s hottest liquid alt trends are defined-outcome and buffered ETFs, offering predefined upside caps with built-in downside protection—ideal for risk-averse investors in volatile times. Innovator ETFs and similar products use options ladders to buffer 9-30% losses while capturing equity gains up to a cap.

Popularity stems from customizing risk in high-valuation markets. Morningstar highlights these as “modifiers,” reducing traditional exposure while enhancing yield via derivatives.

innovatoretfs.comI Innovator ETFs: Buffer ETFs

Laddered allocations, like Innovator’s BUFF ETF, spread buffers across months for smoother outcomes. “Predictable risk management without bond interest rate risks,” experts say.

With record inflows into opportunistic strategies, buffered alts bridge stocks and bonds, redefining diversification in the post-60/40 world.