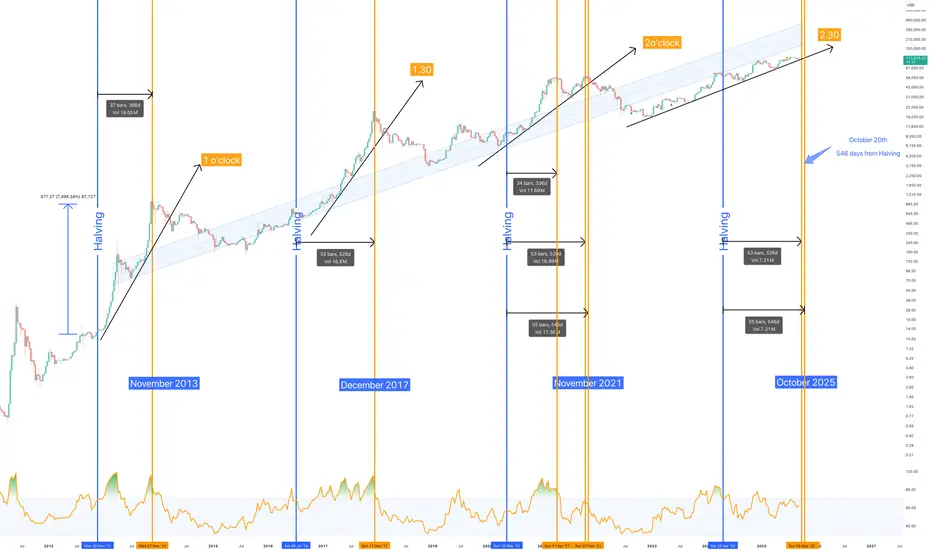

(HedgeCo.Net) As 2025 enters its final quarter, signs are mounting that the crypto market could be positioning for a significant push into year-end. Multiple indicators point toward renewed momentum and institutional activity.

Key signals

- Record futures/options open interest: Bitcoin (BTC) options open interest recently reached a new high of US$65.6 billion as of October 24, indicating strong engagement from leveraged and institutional traders. Crypto.com

- Performance tailwinds: BTC broke previous highs earlier in October, reaching around US$126,500. FinancialContent+1 A major strategist (Tom Lee) noted that an earlier liquidation event (October 10) set the stage for a rebound and potential year-end rally. CoinDesk

- Altcoin activity: Major projects including XRP were leading gains in late October, showing selective strength beyond just Bitcoin. CoinDesk

Why 2025 might be special

- Institutional capital: With ETFs, futures and custody infrastructure maturing, the barrier to institutional crypto exposure has lowered significantly.

- Macro backdrop: Expectations of central bank rate cuts, inflation uncertainty and diversification demand may drive alternative assets like crypto.

- Market structure: High open interest and volatility may attract momentum/trend-followers, potentially magnifying moves.

Risks & calibrations

- October’s performance has been uneven: Despite the bullish signals, the month is tracking toward being weak compared to historic “Uptober” norms. CoinDesk

- Leverage risk: High open interest can amplify moves both up and down — if a shock occurs (regulatory, macro, liquidation), corrections can be swift.

- Fundamentals still matter: While price moves are encouraging, network fundamentals (usage, regulation, protocol health) still underpin long-term sustainability.

What investors should watch

- Market reactions to macro events and regulatory announcements — these can serve as triggers for moves given the leverage environment.

- Open interest and funding rate data for major tokens, which may hint at positioning extremes.

- Fundamental developments in major protocols, adoption metrics, partnerships and on-chain activity — to validate the rally isn’t purely speculative.

- Manage risk: Given the high volatility and levered nature of the market, position sizing, stop-losses or hedging may be prudent.

Outlook

If institutional flows, open interest and macro tailwinds align, crypto could be poised for a meaningful rally into year-end. But as ever, the crypto market mixes opportunity with risk — high upside comes with the possibility of sharp reversals. For both traders and longer-term investors, staying attuned to both technical/market signals and fundamentals will be key in the months ahead.