(HedgeCo.Net) The once-quiet world of liquid alternatives appears to be stirring again in 2025. According to a recent semi-annual study from Lupus alpha (drawing on data from LSEG Lipper), net inflows of €6.9 billion flowed into daily-liquid alternative funds in the first half of the year — a sharp turnaround from prior years. hedgeco.net+3lupusalpha.com+3hedgeco.net+3

The majority of those flows concentrated into more defensive, credit-/fixed-income-oriented strategies: the “Absolute Return Bond” and “Alternative Credit Focus” sub-categories together drew nearly €4.9 billion of the total. hedgeco.net

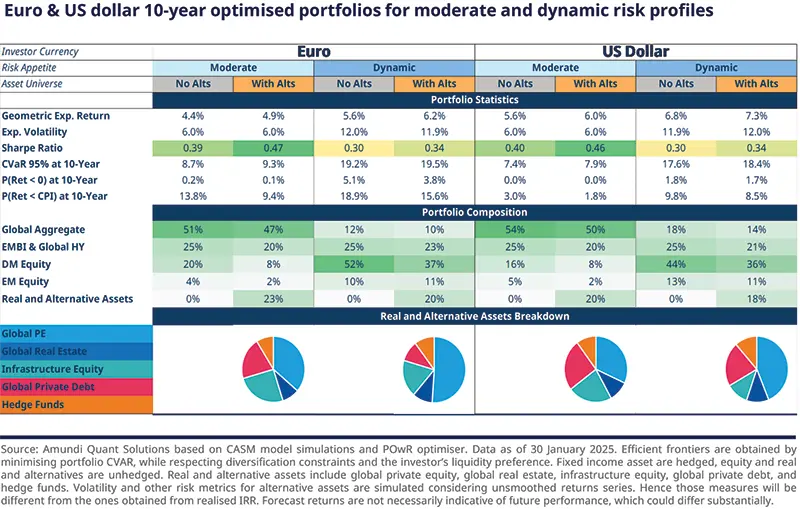

On the surface, the revival signals two things: first, that investors are growing wary of traditional 60/40 (stocks + bonds) diversification schemes, given recent elevated correlation between equities and bonds. According to commentary, the surge in allocations into liquid alts is a result of market volatility, interest-rate uncertainty and the search for “un-correlated” returns. hedgeco.net+1

Second, it indicates that liquid alternatives are moving (slowly) from niche positions into more mainstream portfolio housekeeping. More financial advisors report that clients are asking for “alternative bucket” exposures, and daily-liquid hedge-fund-style mutual funds or ETFs make that easier. hedgeco.net

However, the story isn’t all roses. Despite the inflows, the average fund in euro-terms returned -1.87% in the first half of 2025 — largely driven not by strategy failure but by currency headwinds from a roughly 14% depreciation of the U.S. dollar versus the euro. lupusalpha.com+1

So while investor interest is back, performance has yet to consistently reward it. The implication for the rest of the year: managers will likely feel pressure to deliver stronger results to justify the renewed allocations, and investors will need to maintain a disciplined view of what liquid alts can (and can’t) achieve.