(HedgeCo.Net) As the liquid alternatives segment reassesses its market position, many asset managers and analysts are asking: is 2025 the breakout year? According to BlackRock’s commentary, there are reasons to believe so: they highlight that demand for diversification and hedge-fund-style exposures has picked up, and that alternative building blocks are increasingly being considered for inclusion in standard portfolios. BlackRock

Key tailwinds:

- Elevated volatility and weaker forward visibility in both equities and bonds make the case for alternative, uncorrelated exposures more compelling.

- Easier accessibility: With more liquid alt ETFs, daily-liquid wrappers, and better infrastructure, investors now have more options to access hedge-fund-style strategies via more familiar channels.

- Shift in perception: Rather than niche “hedge?fund lite” products, liquid alts are increasingly being viewed as portfolio building-blocks, especially for institutional allocations seeking diversification beyond plain vanilla. HedgeCo.net+1

Key risks / caveats: - Performance still mixed: Despite inflows, the average liquid alt fund returned -1.87% in H1 (for euro-based investors) — not yet delivering a breakout in returns. HedgeCo.net+1

- Strategy dispersion: Some segments (e.g., macro, managed futures) are still facing outflows, implying not all liquid alt types are riding the wave. Lupus Alpha

- Currency and structural risks: For non-U.S. investors, FX effects remain material. The “liquid” label may hide complexity (derivatives, futures) that require strong operational diligence.

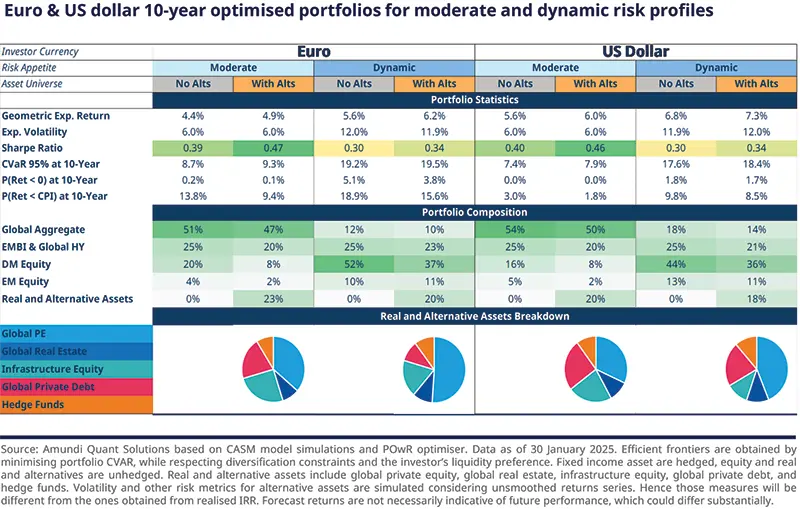

What investors might do: - Use liquid alts as complementary allocations rather than replacements of core equity/bond exposures; e.g., as a diversifier or risk-mitigation overlay.

- Focus on sub-strategy: determine whether you’re looking for downside mitigation (e.g., market-neutral or credit-hedge strategies) or for differentiated return sources (long/short, managed futures) — and choose accordingly.

- Monitor cost and transparency: As the space becomes more mainstream, fee structures, disclosure quality and operational robustness matter more than ever.

Conclusion: While it may be premature to call 2025 a full “breakout year” for liquid alternatives, the signs are promising. If the trend of better access, increasing investor awareness and portfolio relevance continues — and if select strategies can convert increased interest into performance — then liquid alts could move from niche to a more standard part of asset-allocation toolkits. For now, careful selection and understanding of strategy are key.