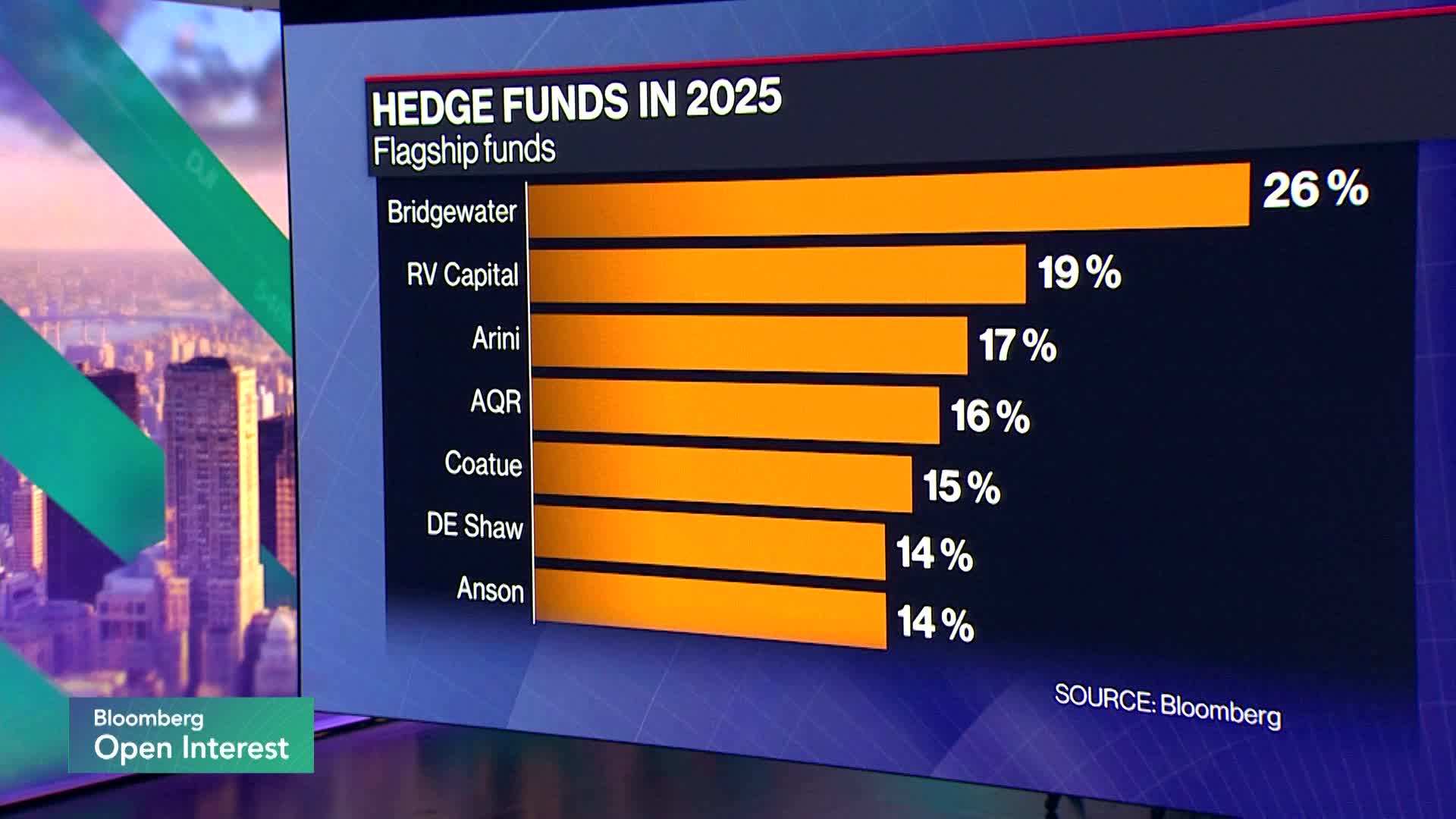

(HedgeCo.Net) One of the largest hedge-fund firms, Bridgewater Associates, has returned to the spotlight. Its flagship macro strategy reportedly gained around 26.4% in the first nine months of 2025 — the strongest performance in 15 years. Bloomberg+1

Market observers say Bridgewater’s positioning benefited from macro catalysts: tariff-driven trade shocks, commodity and currency swings, bond market disruption and equity volatility. For a firm whose macro returns had been tepid in the prior decade, this marks a meaningful turnaround. InvestmentNews

Additional context:

- Macro hedge funds thrive when big economic or policy shifts occur; the post-COVID, higher-rate, trade-friction environment has created conditions that favour opportunistic macro strategies.

- Bridgewater’s success may boost the appeal of macro hedge funds more broadly, potentially attracting more capital to that style.

- But there are caveats: strong performance in one cycle does not guarantee sustained outperformance, especially as scale and crowded trades may bite.

For investors, this performance serves as a reminder of diversification value: when equity/bond correlations rise or markets are volatile, hedge-fund strategies that are less correlated to the broad market may shine. That said, absolute returns, fee drag, and manager-selection remain pivotal.

Take-away: Bridgewater’s strong year highlights that hedge funds — especially macro ones — can still deliver in the right environment. Whether this signals a broader revival remains to be seen.