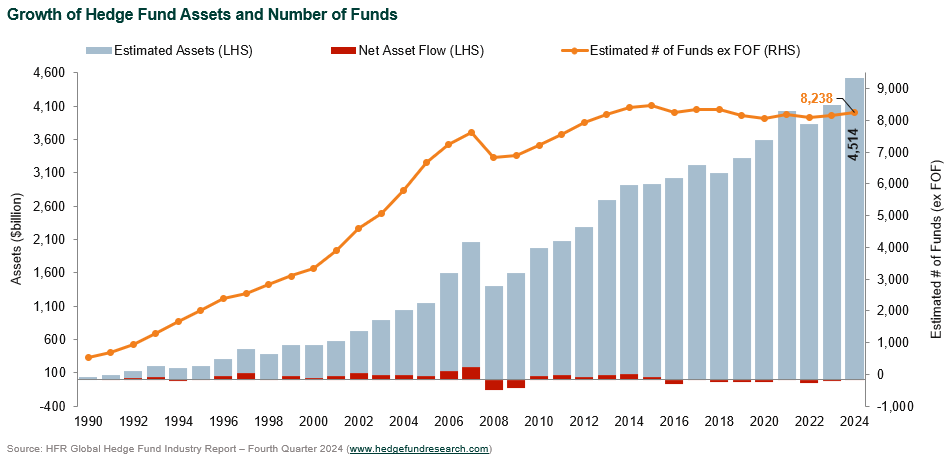

(HedgeCo.NetGlobal The global hedge-fund industry reached a new milestone in the third quarter of 2025, as the total assets under management (AUM) neared $5 trillion, according to data reported by Hedge Fund Research (HFR). Reuters+2IndexBox+2

What’s driving the surge?

- HFR reported that the number of hedge funds globally rose to about 8,464 by the end of Q3. Reuters

- The uptick reflects a mix of fresh capital flows (? $34 billion of net inflows in the quarter) and solid returns across many strategies. IndexBox+1

- Market conditions of heightened volatility, along with investors seeking diversification beyond traditional stocks and bonds, appear to have played a key role.

Implications & commentary

The $5 trillion figure is more than just a round number—it signals a renaissance of sorts for the hedge-fund industry after years of investor scepticism due to rising fees, regulatory pressure and mixed returns. With more capital entering the space, competition for talent, differentiation and performance is intensifying.

However, while growth is strong, challenges remain:

- Larger funds may find it harder to generate high returns due to scale and fewer nimble opportunities.

- Inflated asset bases may raise concerns about market-impact, liquidity and crowding in certain trades.

- The rise in numbers of hedge funds may lead to increased scrutiny, especially if weaker strategies underperform.

What to watch next

- Whether average returns continue to hold up in Q4 amid macro uncertainties.

- Which strategies (multi-strategy, long/short equity, credit, macro) are capturing the bulk of inflows.

- Whether regulatory bodies view the sector’s growth as posing systemic risk.

Bottom line: The hedge-fund industry is back in growth mode—with AUM in record territory, fund launches rising and investor interest rekindled. But this resurgence comes with the need to deliver performance, control costs and navigate evolving regulation.