(HedgeCo.Net) The long-quiet “liquid alternatives” sector—investment vehicles that employ hedge-fund-style strategies but are structured as daily-liquid mutual funds or ETFs—is showing signs of revival this week. According to recent industry data, these strategies pulled in roughly €6.9 billion in net inflows during the first half of 2025, demonstrating renewed investor appetite. HedgeCo.net

The revival is being attributed to several intersecting factors:

- Elevated volatility across equities and bonds, and doubts over the reliability of the standard 60/40 portfolio. Home+1

- A shift in perception, where liquid alternatives are no longer niche “hedge-fund light” products but are seen as mainstream building blocks for diversification. HedgeCo.net+1

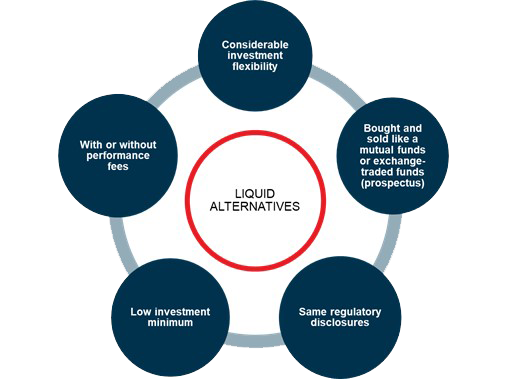

- Enhanced product access and infrastructure (e.g., alternative strategies accessible via ETFs, better disclosures) that make these vehicles more palatable to a broader investor base.

However, the story contains caveats: despite the inflows, many liquid alt funds still posted flat or slightly negative returns in euro-terms. So far, the flows are probably sentiment-driven rather than performance-driven. HedgeCo.net

What to watch:

- Whether the inflows translate into higher AUM and more competitive launch activity in the space.

- Whether performance begins to justify the renewed interest—especially if volatility persists or if market regimes shift.

- Whether the increased interest leads to structural risk: crowding into a few strategies, higher fees, or liquidity mismatches.

For investors and advisors, the message is clear: liquid alternatives may be emerging from the shadows, but the fundamentals still matter—strategy type, manager skill, cost structure, and fit within the overall portfolio.